The food & ag labor problem, fixable?

Prime Future 043: the weekly newsletter highlighting trends in livestock & meat

What is one of the most talked about issues across food & agriculture, yet simultaneously wildly under-innovated and under-invested?

Labor.

This issue got a lot of attention in 2020 because of the pandemic but let's be honest, labor has long been a major issue in agriculture. It's a top-of-mind & keeps-me-up-at-night issue for both producers and processors of all shapes and sizes & across most geographies, whether you have 10 employees on a farm, 100 employees in a feedyard, or 1000 employees in a packing plant.

On twitter this week, a producer mentioned their plans to scale the farming operation and multiple producers replied with "how are you going to find the labor to make this happen?"

Labor issues range in severity from minor headache to actual constraint on business growth to deciding factor on where to build a new plant.

Before we dig into this topic, keep in mind that we've all talked about the expected increase in robotics & automation in processing plants as a solution to some labor challenges. But even with the rise of robotics, smart barns, IoT, etc, for the far foreseeable future there will be significant labor involved in every step of food production and processing.

Optimizing human capital will continue to be an area of opportunity to create outsized impact.

One nuance is that "agriculture" is not a monolith. The seasonal labor needs of a chili farmer in southern Arizona are different than the year round needs of a Tyson plant in Holcomb, KS which are different still than a grower with 10 chicken houses in northern Georgia. The labor market of a specific geography has its own dynamics and market forces. Different size businesses have different dynamics and constraints. Different segments have different skill needs. So saying you have a solution for "agriculture" tells us nothing about who you're really solving for or what dimension of The Labor Issue you are solving.

Some other nuances that make this such a vexing topic for food & ag:

Amount of labor needed - farming and food manufacturing require a lot of human capital.

Localized markets

Specialized skills

Seasonality (some segments)

Hard work....really, really hard work.

Regulatory environments

Ag isn’t a widget production business so people need both good process and good judgement…tricky.

So do we need agriculture specific tech solutions? Yes. You can find several pages on Google search of industry agnostic software solutions for back office processes like payroll. But those solutions don't address the unsolved challenges vexing food & ag leaders, that are much more complex than running payroll. The real problems are things like:

Safety. Farm work can be inherently dangerous. Manufacturing plant work is inherently dangerous. In college I lost a friend to a farm accident and a friend to a feedmill accident. We're talking real human life here. How do we use technology to improve safety and reduce the incidence of injury? How can tech help companies like Cargill that are hyper-focused on safety to further operationalize their safety principles? Or help other companies dial up their focus on improving safety metrics?

Cost. How do we reduce the labor $$ per unit of production? Or how do we turn labor $$ into increased revenue?

Labor availability & workforce management. These 2 issues can be sliced a lot of different ways here are some of the buckets that create the most challenges:

Recruiting - how do you find enough candidates? How do you get the great ones to join your organization?

Training - how do you onboard a new employee as quickly and effectively as possible? How do we give employees the opportunity to level up their game and grow in their current role or into a new role? How do we help supervisors & managers be better at supervising & managing?

Retaining - the cost of turnover varies, but we all know it’s high. How do we keep (good) employees satisfied & engaged so they stay longer?

Rewarding - how do we align individual incentives with business outcomes? I know of a large corn grower that set a bushels per acre goal one year and said that if the goal was met, all employees would get a trip to Hawaii. This pulled everyone in the same direction and not surprisingly, the goal was met. This might not be feasible for everyone but there are about a trillion and one ways to structure rewards. The main idea is to align incentives for metrics that lead to meaningful business outcomes.

These are all threads that could be pulled and the specific implications within farming and processing contexts, but a lot of ink has been spilled on these topics in general by people much smarter than me so let's shift to potential solutions.

An interesting tech company that just raised $300M to expand from oil & gas to construction is Workrise, a "workforce management solution for the skilled trades. We make it easier for workers to find work and for companies to find in-demand workers." Does a company like that move into ag? Presumably. Would/could they account for the nuances in ag mentioned above? TBD.

Here are some AgTech companies that are working on different elements of The Labor Challenge:

Ganaz is "the workforce management platform built for deskless workers in agriculture and food manufacturing. We develop tools to help employers recruit, retain, communicate, onboard, train and pay their workforce."

Summit Smart Farms - helps swine producers by "addressing your biggest challenges in labor and technology so you can equip your team.”

AgButler is "a mobile application designed to help users overcome the challenges of agricultural workforce shortages by creating a network of experienced ag laborers made accessible in real-time. Similar to “ride-sharing” technology, our system allows farmers, ranchers and/or agribusinesses to connect with available laborers filtered by location, ratings, work experience and availability. All done within a secure payment structure organized in the app."

DairyKind and Heavy Connect provide targeted worker training solutions.

From an investor perspective, Connie Bowen with AgLaunch describes it this way:

When we talk about pain points in agriculture, there is no pain more acutely felt by all people in the agrifood system than labor.

Just care about money? Labor is almost always the largest factor in a farm operation's bottom line - people are expensive.

Just care about health? Lack of technical solutions for specialty crops is a huge factor preventing conversion from row crop to fresh fruit & veg.

Just care about ethics? What's more important than humane [working] conditions and living wages?

Just want to invest in a company with a sticky product? Invest in something that does the job and/or enables the farmer and their staff to do the job. Successful past examples include but are not limited to: the steam-powered then diesel tractor [horses/oxen get tired and eat and poop and die], the combine, the cotton gin, effective chemical pesticides.

Labor is a multidimensional problem that is universally felt across food & agriculture. In writing this piece and thinking about it more, my new hypothesis is that labor tech solutions could very well be the most "venture back-able" type of AgTech.

I'd love to know what other companies are tackling this space, just reply to this email if you know any.

Tired of Kodak & BlockBuster as examples of The Innovator’s Dilemma? Here’s one from 1878 courtesy of railroads:

In 1878 Swift (the meat co) hired engineer Andrew Chase to design a refrigerated rail car. Chase's design proved to be a practical solution, providing temperature-controlled carriage of dressed meats. This allowed Swift to ship their products across the United States.

Swift's attempts to sell Chase's design to major railroads were rebuffed, as the companies feared that they would jeopardize their considerable investments in stock cars, animal pens, and feedlots if refrigerated meat transport gained wide acceptance.

In response, Swift financed the initial production run on his own, then — when the American roads refused his business — he contracted with the GTR, a railroad that derived little income from transporting live cattle.

In 1880 the Peninsular Car Company delivered the first of these units to Swift, and the Swift Refrigerator Line was created. Within a year, the Line's roster had risen to nearly 200 units, and Swift was transporting an average of 3,000 carcasses a week. Competing firms….quickly followed suit.

The punchline? The General American Transportation Corporation would assume ownership of the line in 1930.

The moral for big companies? Innovate early or you pay for it later.

Grab the Prime Future ebook (link)

Like what you’re reading? Get all 47 editions of Prime Future to date in one PDF.

Join us on Clubhouse 👋

This week we did a test run for a weekly chat on all the things happening in agtech via Clubhouse, the audio only platform. It was a blast so we’ll be doing it again next week. Use this link next Thursday @ Noon mountain time to join Travis Martin (creator of Magnetic Ag), Shane Thomas (creator of Upstream Ag Insights), Tim Hammerich (creator of Future of Ag podcast), and myself.

I think what I loved about the medium is how informal it is, just a roundtable chat including everyone that joins the room.

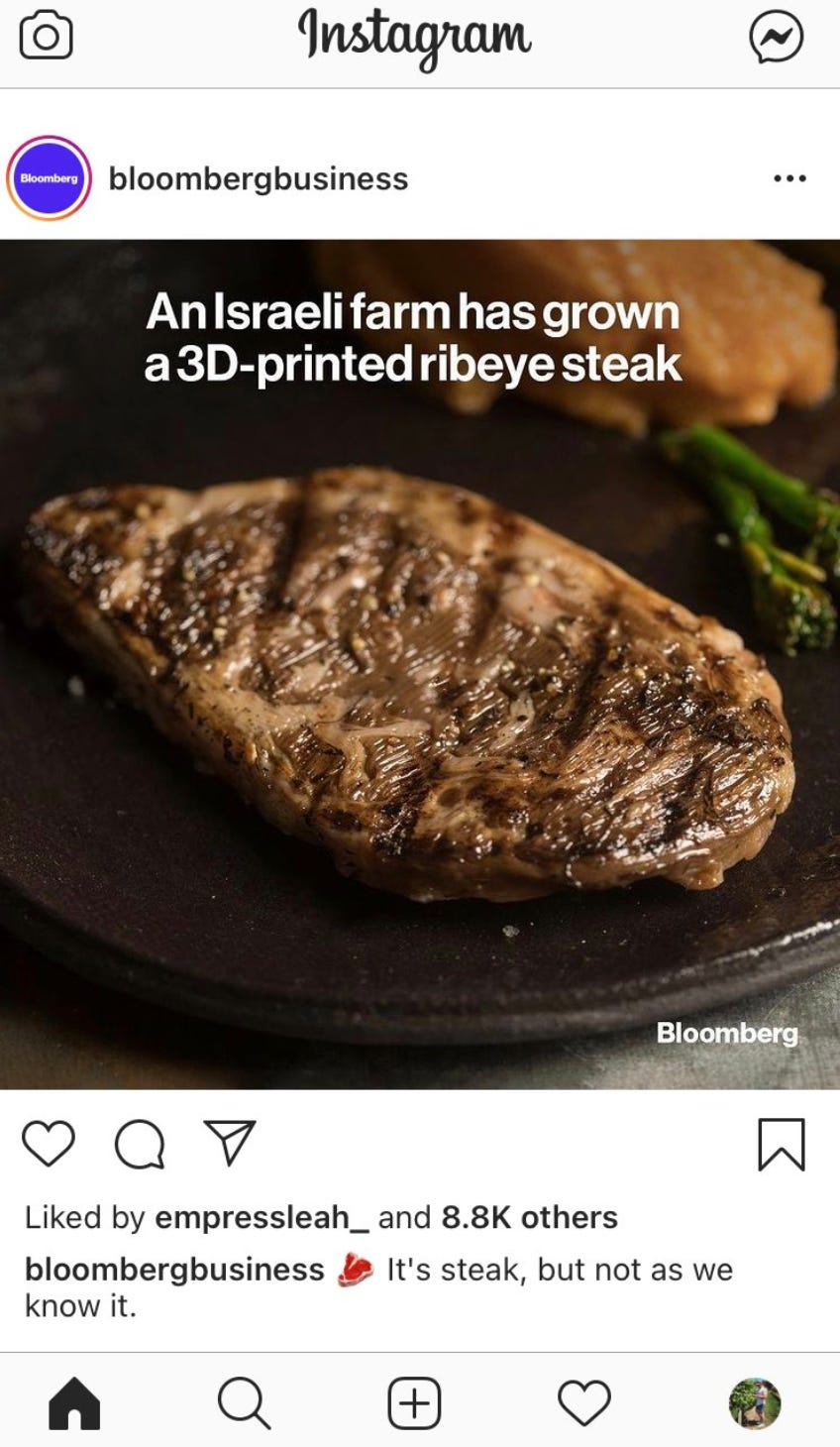

And finally, this wouldn’t be a newsletter on trends in livestock & meat without a hat tip to 3D bio-printed steak. Key quotes from Bloomberg’s article on this week’s announcement:

Aleph Farms made the “world’s first slaughter-free ribeye steak,” the company said Tuesday in a statement. The firm’s technology prints living cells that are incubated to grow, differentiate and interact to acquire the texture and qualities of a real steak.

“It incorporates muscle and fat similar to its slaughtered counterpart.”

The company said last year it was partnering with Mitsubishi Corp. to bring its lab-grown beef to Japan and in 2019 the firm grew bovine cells on the International Space Station.