Never let a (supply chain) crisis go to waste

Prime Future 73: the newsletter for innovators in livestock, meat, and dairy

"If you think about it, the breakout moment for Fintech was the financial crisis of 2008-2009. It forced banks and financial institutions to do things differently. There was backlash against big institutions, we had new regulations like Dodd-Frank.

While what’s happening in supply chain is a little different, for our industry this is our moment of taking our crisis and building the next generation of tech and services. What’s happening around freight tech is very similar to what we saw in fintech in 2008-2009, so the great next decacorns (companies valued $10B+) that come out of venture capital will be associated with some element of supply chains and supply chain technology."

When you see all the activities & excitement & naïveté born by founders and skepticism born by incumbents, this is very similar to where financial services were. We will see some companies emerge from this part of the cycle that go on to be the great leaders of tomorrow. "

That's a quote by Craig Fuller, founder of Freight Waves, a company who’s content has been my go to resource in learning about what's happening with logistics right now.

Craig Fuller grew up in a family that was all about the trucking business. Craig started his career in fintech before starting Freight Waves. Here's how he explains that company:

"If ESPN and Bloomberg had a baby in the back of a truck, it would be Freight Waves. The impetus behind Freight Waves was to create a real time information source for the global supply chain industry.

We originally started to create a tradable instrument based on trucking and trucking rates. We saw a massively volatile market and no way to hedge or offload that risk onto a third party. We actually launched a tradable instrument but that wasn’t very successful and a lot of that had to do with the lack of information in the market. It was an opaque market, there wasn’t a real time data service that provided information so people could trade off of it, and there wasn’t uniformity in the freight market. We’ve tried to focus on all 3 of those things.

A byproduct of creating a failed product is that you find what customers do want, if you have enough capital to survive. The Freight Waves playbook was taken from financial services. Bloomberg’s business model is what we tried to emulate.”

My chat with Craig was one of the most eye opening conversations since I started Prime Future-ing. You can listen to the full audio here (and I totally recommend it):

Now back to Craig's big thesis about freight tech having its moment, let’s put that in perspective. Fintech is the darling of venture capital investors these days, with 1 in 5 VC dollars invested going into the category and 65+ privately held companies valued at >$1B.

So why would Craig think the tiny little logistics space could catch up to financial services in terms of tech investment? Here’s why:

“This is a massive category, let’s not forget that we’re talking about 12% of global GDP. Financial services & insurance are 7.5% of domestic GDP.

Supply chain & logistics represent 8.5% of GDP in the US and 12% globally, so we’re talking about an industry that is bigger and more nuanced than financial services.It’s also easier to trade information which is essentially what a fintech platform is. But what we’re talking in supply chain is the physical movement of goods.

You have this massively fragmented set of decisions, set of parties, set of activitieswhich make it much broader than what you see with fintech. It is so fragmented and so many activities that take place inside the industry, which means it’s ripe with opportunity.”

Here are a few of the many subcategories of freight tech, as Craig sees them:

“(1) Movement of freight - everything around DTC & ecommerce, how do you interact with the big parcel carriers. There are companies that consolidate shipments or create API’s or consolidated workflows.

(2) Warehouse automation services.

(3) Flex warehouse space - The two most successful are Stord and Flex who are doing this with on demand warehouse space with short term agreements instead of long term agreements.

(4) Ocean cargo - ocean booking systems, electronic contracts.

(5) Air freight - Flexport is the most successful forwarding organization that does both ocean & air.

(6) Trucking brokerage - arbitrage, managing freight on behalf of shippers. Companies like Convoy and Transfix doing this.

(7) Visibility - how do I know where all of this freight is and how do I have information about where its going? What’s my eta? Companies like Project 44 and Four Kites are playing here.”

As an aside, you may have seen in the last few days how the CEO of Flexport unleashed the power of Twitter with some semi-simple ideas on how to start unlocking the bottleneck at the ports in CA. I recommend the whole thread here:

Ok so anyway, of course I had to ask Craig about the role of autonomous trucking because to us outsiders, that seems like the almost-ready technology likely to disrupt logistics. If there’s an 80k+ truck driver shortage that’s only expected to grow, isn’t autonomous trucking the answer? Here's what Craig had to say about it:

"Automation and autonomous trucking are great, it all plays well and broader media loves it. The reality is that autonomous trucking is not going to happen as quick as people believe it will in the mainstream.

This stuff is 10-20 years out.It will be massively transformative of our economy, but it’s not going to happen overnight. Autonomous trucking is getting all the attention but what I’m really excited about is all the pipes and mechanics of movement of cargo, money and info.Ports have been early adopters (of autonomous trucking). The Port of Rotterdam has had a semi autonomous, closed loop environment for years. You’ll see these closed loop environments maybe around an airport or a warehouse where you’re shuttling trailers or containers from one door to another, that happens a lot. Those applications will see autonomous first. But I don’t think we’ll see autonomous trucking services in the US before we see it in other parts of the world - places like Japan that has major demographic challenge and are very tech forward. They have a labor problem and its different than ours than ours because of their elderly population.

You have to remember that in order to have full autonomous trucking you need the federal, state and local rules and laws to correspond. Imagine the difficulties of that. When talking about autonomous trucking, you have a situation where the #1 job in 29 states is truck driver.And that is in states that are traditionally pro-business, so it creates a lot of difficulty to expect that technology to be adopted quickly.The reality is that we are in the very early days, but there is so much opportunity."

I also asked Craig, what should us normies know about the logistics industry?

“People don’t realize how BIG the industry is. 8 million people are employed by logistics in the US, 100 million across the world. So it’s a massively important segment. This is the physical economy. You can’t sell agricultural products unless you can transport them, and transportation costs impact the overall cost of finished goods.

People are waking up to the fact that supply chain is so prone to disruption and weather and geopolitical events. The reality is we’re now aware of it. I use the analogy of your power company - no one thinks about the power company until the power is out and then it’s ALL you think about. No one thinks about how product gets from point A to point B until the product doesn’t show up.

At the end of the day the market has always worked this way and there’s always been issues but we’ve never had so much freight in the economy at a time when so few people were willing to drive trucks and work warehouses. So its created this massive bottleneck.”

“No one thinks about the power company until the power is out and then it’s all you think about. No one thinks about how product gets from point A to point B until the product doesn’t show up.”

Here’s what Hill Pratt, Managing Director of the Transportation Business Unit for Dairy.com, had to say about the tech that will enable the future of logistics in milk hauling:

“The dairy industry increasingly recognizes that it is in a competition for qualified drivers against all other industries. A high volume of local moves and consistent year-round shipping activity provides some advantages. But, there are negatives as well… Cows don’t take any holidays, so Sundays, Thanksgiving, Christmas and Easter are regular workdays for dairy haulers. Also, some plants are notorious for excessive wait times and denying detention pay. It doesn’t take very many incidents of drivers missing family dinners or their kids’ sporting events before they start looking at want ads from other industries offering predictable hours and fat signing bonuses.

Therefore, the industry is increasingly focused on resolving the causes of long and unpredictable plant waits and developing consistent, automated detention programs. Technology is at the center of these solutions.

Specifically, real-time shared integrated scheduling/trading and transportation platforms are essential to developing and coordinating plans that keep wheels moving and inventory turning.Also essential is integrating these platforms with real-time load tracking/GPS platforms, so that:(1) Real time bottlenecks and delays are identified and resolved earlier.

(2) Accurate load-level historical wait time data is captured, enabling business intelligence tools that sit on top of these massive datasets to help supply chain managers identify delay patterns, develop solutions, and create business cases to justify process change, staff adds, and capital investments.

(3) Provide accurate plant in/out time data to power automated detention tracking and payment approaches—so that haulers get what they deserve without the headache of creating detention invoices, and, plants are accurately charged for detention. Automated detention relies on integration of scheduling, load arrival and load departure data—so plants don’t get dinged if haulers arrive early or miss an appointment times, but haulers are compensated accurately when plants hold them up.”

On a very related note, James Turner, General Manager of M2X US, added this context around the gap between current state and future state:

“In the United States, agricultural products are the single largest user of freight services comprising 24% of the share across all loads by tonnage. While agriculture products hold this position of significant overall volume in the US supply chain, its logistics network lacks technology facilitating communication and efficient transportation within the industry sector.

Generally, the agriculture supply chain to date is tightly bound to lagging information communicated through paper, phone calls, emails, and more often than you could bear to imagine in this era, handwritten documents.Additionally, with the ever-growing demands on industries to find more sustainable methods of producing goods, the agriculture supply chain has a unique opportunity to adopt smart technology which, through optimization, can reduce empty miles driven while also reducing costs. This results in higher profit margins for carriers and lowers costs for shippers all the while significantly reducing the overall carbon footprint of the agriculture supply chain.”

(What is M2X? From their website: “M2X was founded with the vision to improve the efficiency and sustainability of livestock transport across New Zealand. We now offer TMS solutions for carriers and enterprise customers across many industries including livestock, milk, forestry, bulk and agricultural products, and general freight. Our integrated Platform approach enables carriers and enterprise companies to work together to achieve and share the benefits of digital efficiencies and optimisation.”)

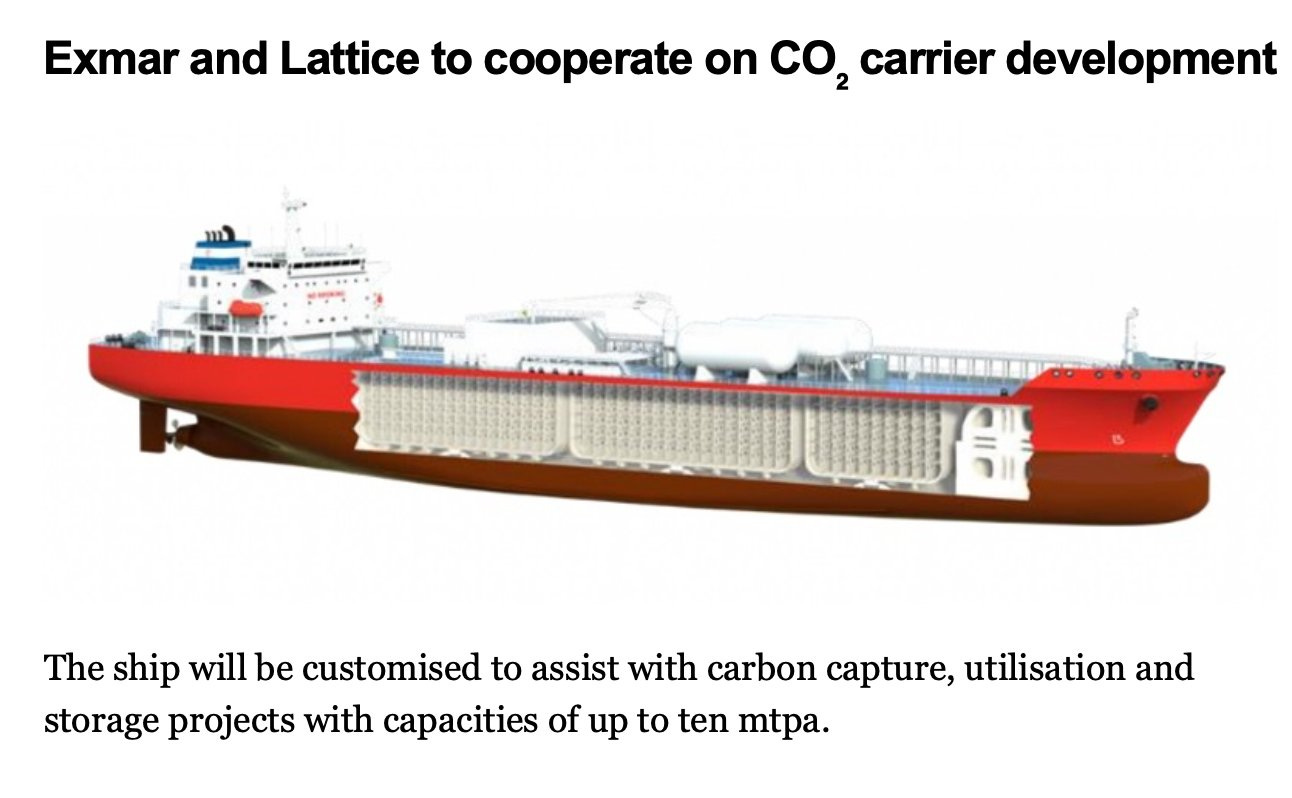

James’ carbon comments also lead us to ship technology. A few weeks ago I subscribed to a newsletter on ship technology (cleverly called Ship Technology), and its staggering how many of their stories have to do with ship companies launching new types of ships that have a carbon / emissions improvement angle. These are not announcements of investors putting money into these projects, these are announcements by customers of the technology which signals its much closer to reality. Here’s one that even mentions carbon capture:

What a fascinating time in supply chain as today’s supply chain crisis intersects with abundant capital and rapid tech developments. Winston Churchill said it best:

“never let a good crisis go to waste”

Previous installments of this supply chain series

(1) Love Me Tenders: a supply chain story (link)

“Supply chain talk is e.v.e.r.y.w.h.e.r.e these days so I'm kicking off a series on how supply chain disruptions & dynamics are impacting livestock, meat & dairy. To start, we look at 2 macro concepts, what’s happening in milk hauling, and a chicken supply situation at the fictitious fast food chain, Love Me Tenders.”

(2) Sea cowboys & flying sheep (link)

“Meat isn't the only thing exported, live animals are also exported. The global annual value of live animal exports is $24 billion. Put that in perspective - that's roughly the equivalent of the entire US swine industry. It’s also a tiny little speck of the ~$800B global meat business. But every day there are five million head of livestock criss crossing the oceans of the world. That seems like something worth looking into for curious people like us…”

I’m interested in all things technology, innovation, and every element of the animal protein value chain. I grew up on a farm in Arizona, spent my early career with Elanco, Cargill, & McDonald’s before moving into the world of AgTech & early stage companies.

I’m currently on the Merck Animal Health Ventures team. Prime Future is where I learn out loud. It represents my personal views only, which are subject to change…’strong convictions, loosely held’.

Thanks for being here,

Janette Barnard