Friends - Today I’m excited to share (1) some news, and (2) some thoughts on the Farmers Business Network announcement about their acquisition & entry into animal health/nutrition distribution. Here we go….

(1) The next 90 years

The pandemic brought an unanticipated but surprisingly great temporary move home to help care for my elderly grandparents. In addition to daily domino games to bookend Zoom calls, I got to hear all the stories and perspectives on life and agriculture from their 70+ years of farming. Some favorite quotes:

“Kid, the thing about opportunity is its always there when you look for it. You just gotta find the right window where it's the right thing for you and the right timing. And ya gotta stay in the game, ya gotta just stay in the game.”

"People say farming is harder now. When was it ever easy? It has been challenging for as long as people have farmed.”

"Don't do what the coffee shop boys do. They're playing it safe, doing what everybody else is doing, going broke when everybody else goes broke."

One interesting thing about living with old people is getting a fascinating glimpse into depression era food habits & attitudes. The juxtaposition is that at 89 years old, my granddad considers one dimension of success that his family has consistently had meat on the table. But when they want a comfort food kinda meal (the throwback to childhood kinda meal), it's inevitably a low meat/heavy starch situation:

Cornbread and milk

Tomatos and gravy

Black eyed peas

Potatos fried in lard

Most of those food preferences reflect depression era resources in rural Oklahoma:

A garden

Milk from a dairy cow (the more fortunate families)

Slaughtering a pig once, maybe twice a year and canning the meat. Any additional pigs were sold for income. Turns out they slaughtered the pigs around 340-350 lbs to maximize for lard. 🥴

Some chickens to eat, because obviously chickens are cheaper to raise than pigs. And beef wasn't on anyone's plate in their rural community....way, way out of economic reach.

(Fun fact: I always knew black eyed peas’ center of gravity of popularity was in Oklahoma but my granddad recently explained that as FDR dealt with the simultaneous effects of the dust bowl and the Great Depression ravaging the rural economy and leaving families in abject poverty, one solution to both conserve top soil AND put food on tables was a program to incentivize planting black eyed peas.)

Now contrast all of that with today.

Meat is the center of the meal for most people, most of the time, in developed countries. Meat & poultry is one of the first ways an economy trades up as incomes increase. Meatless meals are generally a bougie political statement, not an economic consequence. So why does my generation not think twice about having ready access to meat when my grandparents still view it with a hint of amazement?

(1) The general rise in prosperity across America. In the mid 1930’s, ~45% of Americans lived in poverty. In 2021, ~9% of Americans live in poverty. Without a doubt, sheer purchasing power has recalibrated most Americans expectations and views on food choices and meat in particular which transformed demand.

(2) The lengthy list of innovations over the last 90 years that have transformed the supply of animal protein, enabling increased production and decreased cost, such as:

Widespread adoption of refrigerated freight, allowing for more efficient geographical allocation of production & processing.

Antibiotics to treat sick animals, vaccines to prevent and other medicines to manage disease.

Genetic advancements and decades of genetic selection to make more/better/faster meat.

Specialized production and economies of scale in livestock production & processing.

Facilities - for pork and poultry, innovation around the engineering and management of housing to create the optimal temp, humidity, air flow for growth.

Steam flaked corn in feed yards so cattle could process the feedstuff more efficiently.

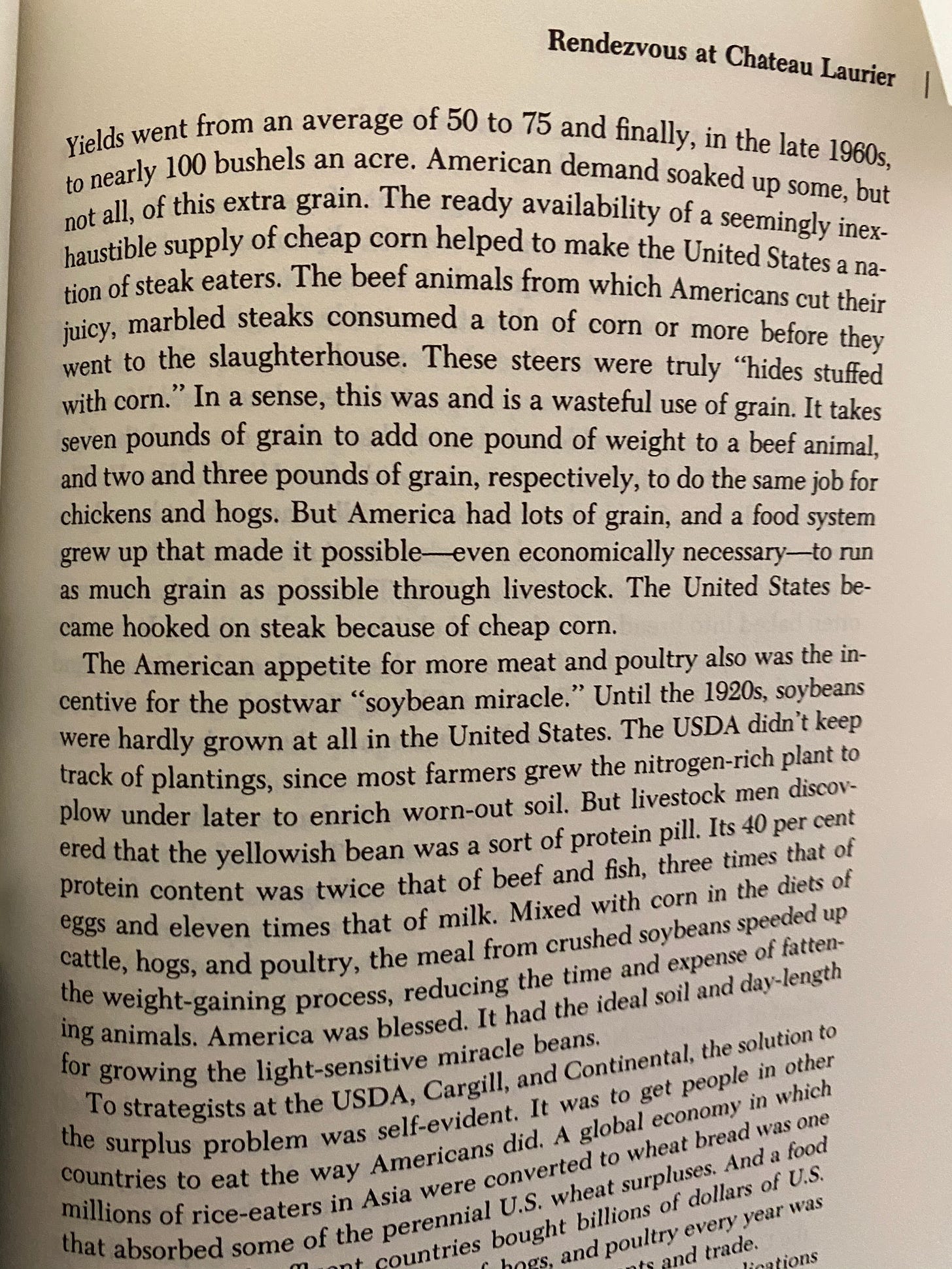

Corn yields went from 50 to 250 bushels/acre...and we discovered the power of protein found in soybeans (read the image below, an excerpt from Merchants of Grain)

Most of the trends above that drove the massive growth in animal protein throughout the last 90 years were a function of the relentless focus on efficiency, on reduced cost per pound of meat/poultry produced. I recently mentioned the idea that if "all business is bundling and unbundling", it seems our corollary is "all agriculture is commodity scaling and differentiating". In recent years, the pendulum has started the slow swing from commodity scaling back towards commodity + a whole host of of differentiation opportunities.

It’s the messiness of the pendulum swinging process that creates opportunity for new businesses, new business models, and/or new markets. And by messy, I obviously mean deliciously exciting.

If you're a regular Prime Future reader, you know I'm bullish on how technology can enable livestock & poultry producers who are in pursuit of either commodity scaling and/or differentiating. This intersection of meat/livestock and tech is about enabling more profitable production, increased sustainability, and ultimately increased end customer delight….all of which will enable the next era of livestock & poultry growth over the next 90 years.

All of that is why I'm excited to share that I'm joining the Merck Animal Health Ventures team! I'll be working with an organization that is actively betting on digital tech’s role in livestock & poultry production. Please reach out if we should connect.

Grab the Prime Future ebook (link)

Prime Future will also be changing, likely moving from weekly to monthly. While my goal will be the same, to highlight emerging trends across animal protein and opportunities for innovation, stay tuned for specifics. Thanks for being here.

In the meantime, you can access all editions of Prime Future published so far!

(2) Farmers Business Network - another aggregator on the scene?

We’ve talked about Telus Agriculture as the mark of Animal Agriculture 2.0 but as of this week, we add Farmers Business Network to the mix…and now it’s a party over here in animal agtech😁

Background: FBN has raised $571M since its founding in 2014. The company describes itself as “an independent ag tech platform and farmer-to-farmer network. FBN has set out to redefine value and convenience for farmers by helping reduce the cost of production and maximize the value of their crops.”

Charles Baron, co-founder and VP of Livestock told Successful Farming:

“What’s important to FBN is to help farmers maximize profit potential across the breadth of the farm. For many of our members, livestock is just as important as crop production. Well over half of our 24,000 members have livestock. We want to be able to support and help them in the exact same platform.”

Prairie Livestock Supply adds to the FBN portfolio:

Prairie Livestock Supply: A leading pharmaceuticals supplier for swine, beef, dairy, and poultry.

ProPig and ProCattle: A feed and nutrition services provider.

The acquisition adds a team of 40 professionals, including veterinarians, animal health sales specialists, and nutritionists with expertise in swine, beef, dairy, and poultry. FBN members in select states can now also access clinical veterinary services for beef cattle, swine, and dairy through a partnership with Southwest Veterinary Services, a new offering made possible by the acquisition.

FBN’s multispecies livestock platform now provides farmers with an array of transparently priced, high-ROI products and services.

The FBN Pharmacy has a full line of animal health pharmaceuticals and supplies from branded and generic manufacturers, which gives producers control to choose the products that best fit their operation. Animal health products are supported by a team of veterinarians and shipped direct to the farm in 41 states and counting.

FBN’s broad and growing feed portfolio includes transparently-priced dry feed, liquid supplements, lick tubs, and nutritional services for beef cattle, swine, and poultry — available in select states. Bulk and bag feed is delivered direct to the farm with 0% interest financing available to those who qualify.

FBN Finance and FBN Insurance are available to producers for financing inputs and purchasing livestock insurance.

Lastly, through its partner, Southwest Veterinary Services, FBN members will be able to access full clinical veterinary service capabilities for dairy, swine operations, and beef cattle, as well as access to autogenous vaccines.

As I think about FBN’s strategic advantages in moving into this space, they include:

Farmer network - bringing new offerings to existing customers (of both FBN and Prairie Livestock Supply) as a way to keep customer acquisition costs low could be a huge advantage.

Learnings - FBN has sought to restructure the input sector including both the sales and distribution model. As they seek to apply those learnings to restructure how inputs are sold and distributed to livestock producers, how well will these learnings translate? Give them a minute to play around with this acquisition and get some direct experience in the livestock space…

Dry powder - they’ve raised a lot of money and investors appear to be pro-FBN which should translate to relatively easy access to capital, aka the ability to do more acquisitions and invest heavily in this space.

The whole animal tech ecosystem benefits from more serious players, with multiple strategics and/or mid-market companies that can acquire and aggregate tech offerings. FBN seems to be positioning itself as one of those players, and is in a position to at least give their crop input playback a good run in livestock.

Will it add a huge hook in the story for FBN if/when they IPO? Presumably.

Will it work? TBD.

So much here is TBD except for the fact that a big player innovating around distribution to dairy, cattle, independent hog producers should mean more innovation will come to that space, like it has in crop input distribution.

Here’s the page on the “soybean miracle” from the book Merchants of Grain:

…so interesting, right??