Plant-based meat? We'll see.

Prime Future 124: the newsletter for innovators in livestock, meat, and dairy

As of this writing, Beyond Meat is trading at $12.63/share down from a 52-week high of $109.76. Absolutely brutal.

Meanwhile, JBS shut down Planterra and McDonald’s scratched plans to roll out the McPlant burger nationally.

Across the meat industry these days, there seems to be a lot of jumping up and down on the anticipated graves of plant-based meat companies, and the entire category.

In March I wrote RIP plant-based meat mania (full text below), an analysis that still largely reflects my POV on the category.

But in spite of those celebrating what looks like the plant-based meat category losing its sizzle, here are 3 things to keep in mind…

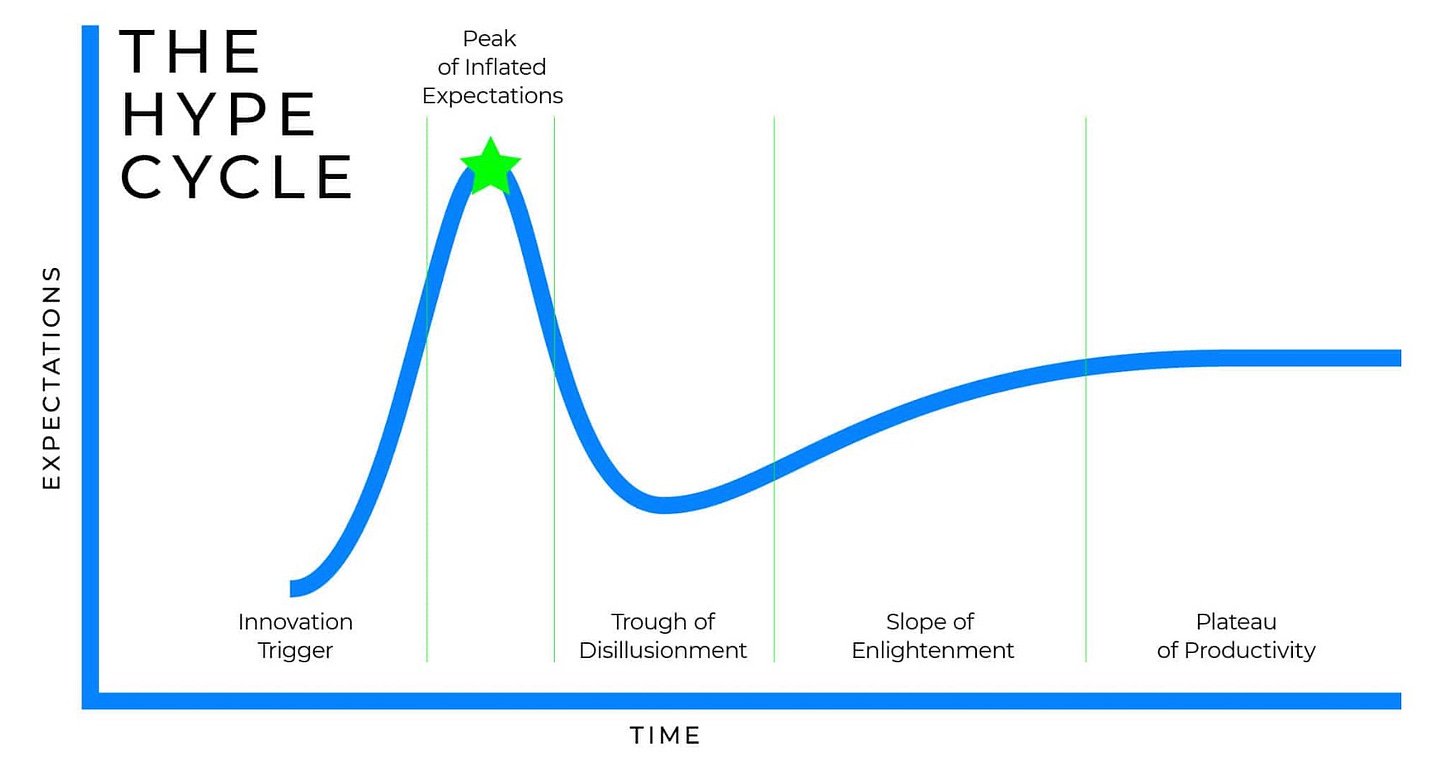

1) The hype cycle:

Where is plant-based meat on this chart? Maybe the trough of disillusionment, at least for investors but also a lot of customers & consumers. A question is whether it follows the trajectory here, or continues to fall.

Though perhaps the question is whether plant-based meat even belongs on this chart, was there even an innovation trigger? Or was the entire plant-based meat category boondoggle based on a narrative trigger from some skilled-at-storytelling anti-animal founders dressing up the veggie burger with a whole lotta venture capital?

2) The X factor

Even if plant-based meats have peaked and it’s all downhill from here, there is another X factor that we have no idea how it will impact meat: cell-based meat.

The cell-based meat category has also had massive investment, but companies in that category are largely still working out the technical and scaling risk.

It remains to be seen a) how regulators will deal with cell-based meat, b) how well cell-based meat can compete on taste and texture, c) how well cell-based meat can compete on price, and d) how consumers will respond to it / which markets will be a fit.

3) A Chinese proverb:

A farmer and his son had a beloved stallion who helped the family earn a living. One day, the horse ran away and their neighbors exclaimed, “Your horse ran away, what terrible luck!” The farmer replied, “Maybe so, maybe not. We’ll see.”

A few days later, the horse returned home, leading a few wild mares back to the farm as well. The neighbors shouted out, “Your horse has returned, and brought several horses home with him. What great luck!” The farmer replied, “Maybe so, maybe not. We’ll see.”

Later that week, the farmer’s son was trying to break one of the mares and she threw him to the ground, breaking his leg. The villagers cried, “Your son broke his leg, what terrible luck!” The farmer replied, “Maybe so, maybe not. We’ll see.”

A few weeks later, soldiers from the national army marched through town, recruiting all the able-bodied boys for the army. They did not take the farmer’s son, still recovering from his injury. Friends shouted, “Your boy is spared, what tremendous luck!” To which the farmer replied, “Maybe so, maybe not. We’ll see.”

The moral of this story, is, of course, that no event, in and of itself, can truly be judged as good or bad, lucky or unlucky, fortunate or unfortunate, but that only time will tell the whole story.

All that to say, plant-based meat? We’ll see.

Prime Future 92: RIP plant-based meat mania (link)

I am often asked about my view on alternative meats and the threat they pose to old fashioned, plant-fed meat. I’ve stayed away from that question, for the most part because I’m just more interested in plant-fed meat.

First, it's important to separate "alternative meat" into 3 distinct buckets: plant-based, fermented, cell-based.

Today we are looking at the plant-based meat category. Spoiler alert: I find the plant-based meat category bland and uninspiring. And honestly, I think we can reasonably lay plant-based meat mania to rest in peace in the history books, right alongside 1990's emu farming mania in the US.

Some background on VC's appetite for the category:

"Plant-based meat, egg, and dairy companies received $2.1 billion in investments in 2020 — the most capital raised in any single year in the industry’s history and more than three times the $667 million raised in 2019. Plant-based meat, egg, and dairy companies have raised $4.4 billion in investments in the past decade (2010–2020). Almost half, or $2.1 billion, was raised in 2020 alone. This included Impossible Foods’ record $700 million funding haul."

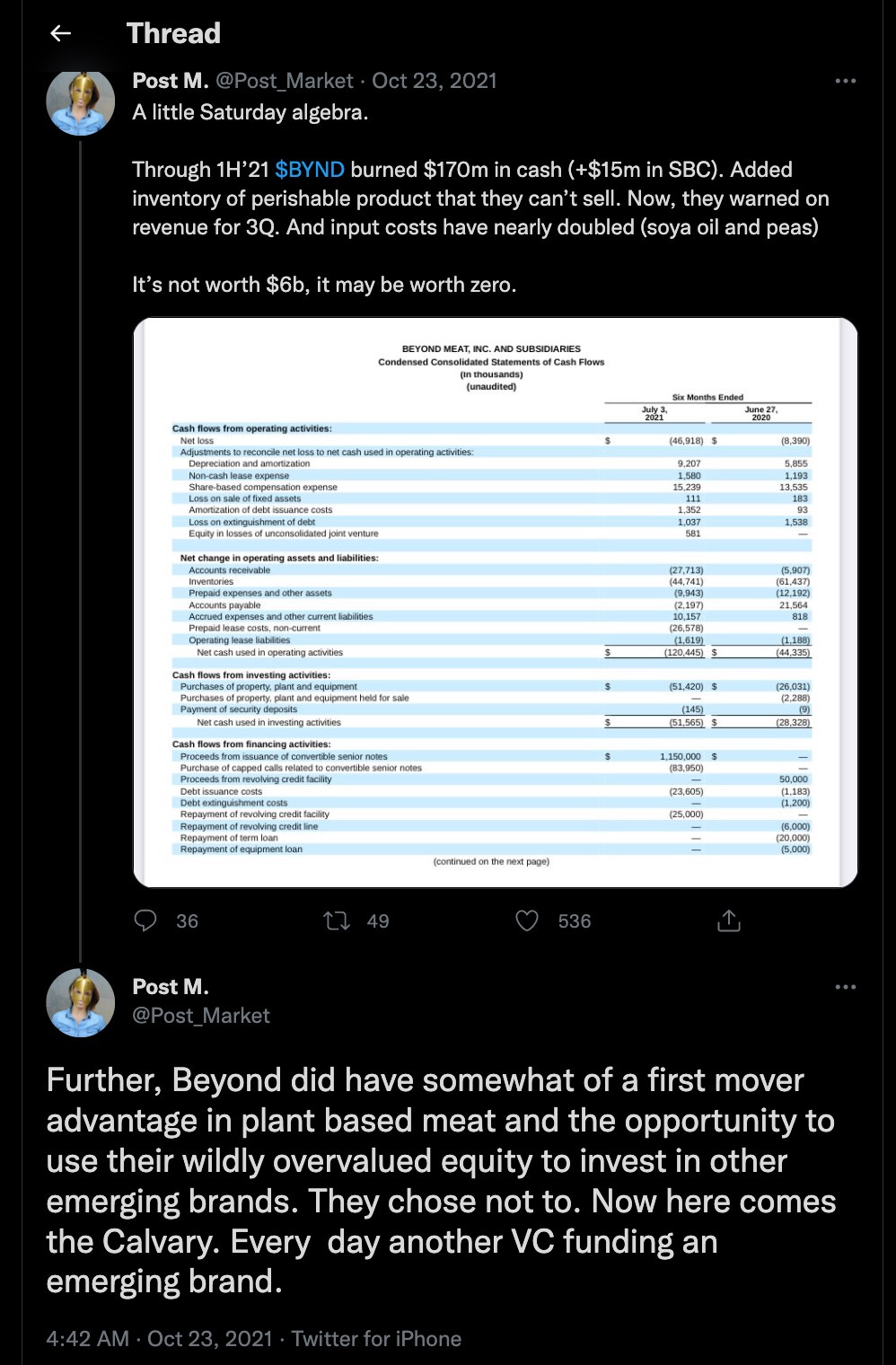

In addition to Impossible Foods, the other elephant in the plant-based room is Beyond Meat, which has sent investors on a roller coaster since their 2019 IPO.

Here's the category update, according to the Wall Street Journal:

"Beyond shares peaked above $234 in mid-2019 after the company’s initial public offering at a price of $25 earlier that year. Shares have fallen since then as meat alternative makers have dealt with pandemic-related challenges and uncertainty around the products’ growth prospects. Beyond’s stock has fallen about 71% in the past 12 months.

Maple Leaf Foods Inc, a Canadian meat company that in 2017 acquired plant-based food maker Lightlife Foods, this week said that an internal company analysis showed that after years of rapid growth, the category had stalled.

“All major brands and products across the category are experiencing similar challenges, which largely seems to be driven by consumers’ experience in terms of taste, price, degree of processing and ease of preparation,”said Curtis Frank, Maple Leaf’s president."

Womp, womp…

Now layer on 3 dynamics about plant-based meat mania....

(1) Timing - conditions over the last 24 months were all that plant-based meat companies could have hoped for, but it wasn’t enough.

Beyond Meat when public in 2019, then record levels of venture capital flowed into the category in 2020. This was during a time when total money flowing into the venture capital class was exploding, and public markets were frothy.

And, it was at a time when plant-fed meat began selling at record prices in the meat case over the last two years, at times even being unavailable.

And yet, the plant-based meat category appears to have stalled.

(2) Competition is fierce and growing, which will continue pressuring (already negative) margins.

Plant based meat is an increasingly crowded market, including private label brands intent on competing on price, driving down margins of the whole category. If I'm a retail sales exec for a meat packer, I'm looking at this dynamic and thinking 'welcome to the real world, kids!'

Like with any emerging trend, what matters is not the absolute size of the plant-based category relative to plant-fed meat....what matters is the growth rate.

But if the growth rate is slowing, and more emerging brands are popping up then suddenly the category is crowded and competing on price and suddenly the whole category is much less interesting to investors.

This picture is from the meat case in Safeway. Notice the seeming price differential. In reality, the plant-based burgers are $.749/oz while the prime chuck burgers are $.519/lb. But ignore the price differential, the visual quality cues here are striking, right?

You have to really want plant-based meat to pick up the one on the right; you have to have a compelling why behind that purchase….don’t you?

Especially in a time when plant-fed meat quality is high. As in ~90%-of-US-cattle-grading-choice-or-prime kinda high. That's really high.

(3) Plant-based meat: it's still just a veggie burger.

We've talked before about the 2 things venture capital has funded for plant-based meat companies are product development and marketing.

The plant-based meat category was not invented by Beyond Meat or Impossible Foods, but it was dressed up & juiced up by venture capital.

What I find most interesting about Beyond's latest quarter results is that while total revenue was only down 1.2% YoY, retail sales were down 19.5%. Foodservice is the sales channel where Beyond is moving more product YoY. But my hypothesis is that much of the foodservice lift is from QSR chains like Burger King and White Castle trying to get a PR lift.

But the canary in the coal mine is McDonalds, and the test they are running with the oh-so-cleverly named McPlant burger. For 3 reasons:

Menu board space is precious. Items have to earn their spot.

Menu board space is all the more precious now, since the menu has been pared down to simplify operations and decrease wait times amidst labor shortages.

Amidst a pared down menu board, sales have increased. Correlation or causation is hard to say, but it does seem reasonable to think that the hurdle to add something to the menu has been raised.

If McDonalds rolls out plant based burgers on a broad scale beyond the current trial, then my view might change.

Ok that’s a lot of negativity in one article….oops. But now let’s talk about the most important aspect: taste.

I've done the obligatory tasting of an Impossible burger and it tasted 97% like mushy cardboard.

But let’s say 90% of my reaction was influenced by my bias towards plant-fed meat. So let's say the burger actually only tasted 7% like mushy cardboard. Is there really a massively growing market of repeat buyers for something that has even a hint of a mushy cardboard eating experience? Especially in a time when meat quality is at all time highs.

But actually the obvious risk to my entire analysis is that I'm operating out of a complete bias towards plant-fed meat and it's cultural, nutritional, environmental, societal, and experiential superiority over plant-based meat. I'm unabashedly bullish on animal protein. So perhaps this entire analysis will be proven laughably wrong over time...

One reason I do not anticipate that to be the case though, is The Lindy Effect:

“the Lindy effect proposes the longer a period something has survived to exist or be used in the present, it is also likely to have a longer remaining life expectancy. Longevity implies a resistance to change, obsolescence or competition and greater odds of continued existence into the future.”

I can't think of a better example of The Lindy Effect than meat. Humans have been eating meat for a long, long time...that won't change with marketing splash.

Where are my plant-based bulls?

I’ve lined out the (really) bear case about the plant-based meat category and why the sizzle will fizzle out and the category will continue to be a fixture in the meat case, albeit a shrinking fixture.

And yet, many many folks see the bull case for plant-based. That's who I want to hear from - if you are a plant-based bull, tell me more about why that is.

What do you see that makes you optimistic the category's growth rate will return to pre-2021 levels and sustain or even accelerate?