Vertical Integration 2.0

Prime Future 74: the newsletter for innovators in livestock, meat, and dairy

Along with many other processors, a poultry integrator recently announced increased wages for processing plant employees and truck drivers. Because poultry is so vertically integrated, I’ve just assumed that most poultry co's own the trucks and trailers to transport eggs from breeder farm to hatchery, chicks from hatchery to growout farms, feed from mill to farms, and live haul to take birds from farm to plant.

However, what I’ve learned is that there is actually a shift away from company owned truck fleets because of the management and capital required to keep those assets on the books. While some truck drivers are still employed directly by the integrator, like for delivering chicks to farms, and some of the trucks and/or trailers are company owned, more and more of these activities are outsourced to third parties.

I find this really interesting. We tend to think of the livestock, meat & milk business as part of an inevitable march towards increased consolidation and increased integration. (Note: those are 2 related but very separate concepts. Consolidation is when a company buys a competitor, vertical integration is when a company buys a supplier or customer.)

Yet here is an example, albeit potentially small, of reducing vertical integration by outsourcing at least some portion of a reallly critical activity.

One data point may not indicate a trend, but the whiff of vertical disintegration in trucking & logistics for meat & poultry companies does raise some questions:

Why are the integrators moving away from owning trucking capacity?

How will truck driver shortages of 2020-2021 (and likely 2022) impact that trend?

Is this a one off trend or a part of something larger? Are integrators divesting assets in other important-but-not-core activities?

More importantly, given the chaos in labor markets & truck driver shortages of 2020-2021 (and likely 2022), how will this impact the ownership model for integrators moving forward?

"There are only two ways to make money in business: one is to bundle; the other is to unbundle."

The tech industry loves that quote, and it's usually used in the context of bundling & unbundling consumer products, e.g. cable TV vs Netflix. Sometimes it’s used in the context of bundling & unbundling companies to create shareholder value, e.g. GE of 1990 vs GE of 2021.

What if it also applies to how we think about supply chains? Such as, oh idk, commodity supply chains like meat, milk & poultry? We could even use the alternative phrases of vertical integration & vertical disintegration to describe bundling & unbundling.

Metrics: what financial metrics matter?

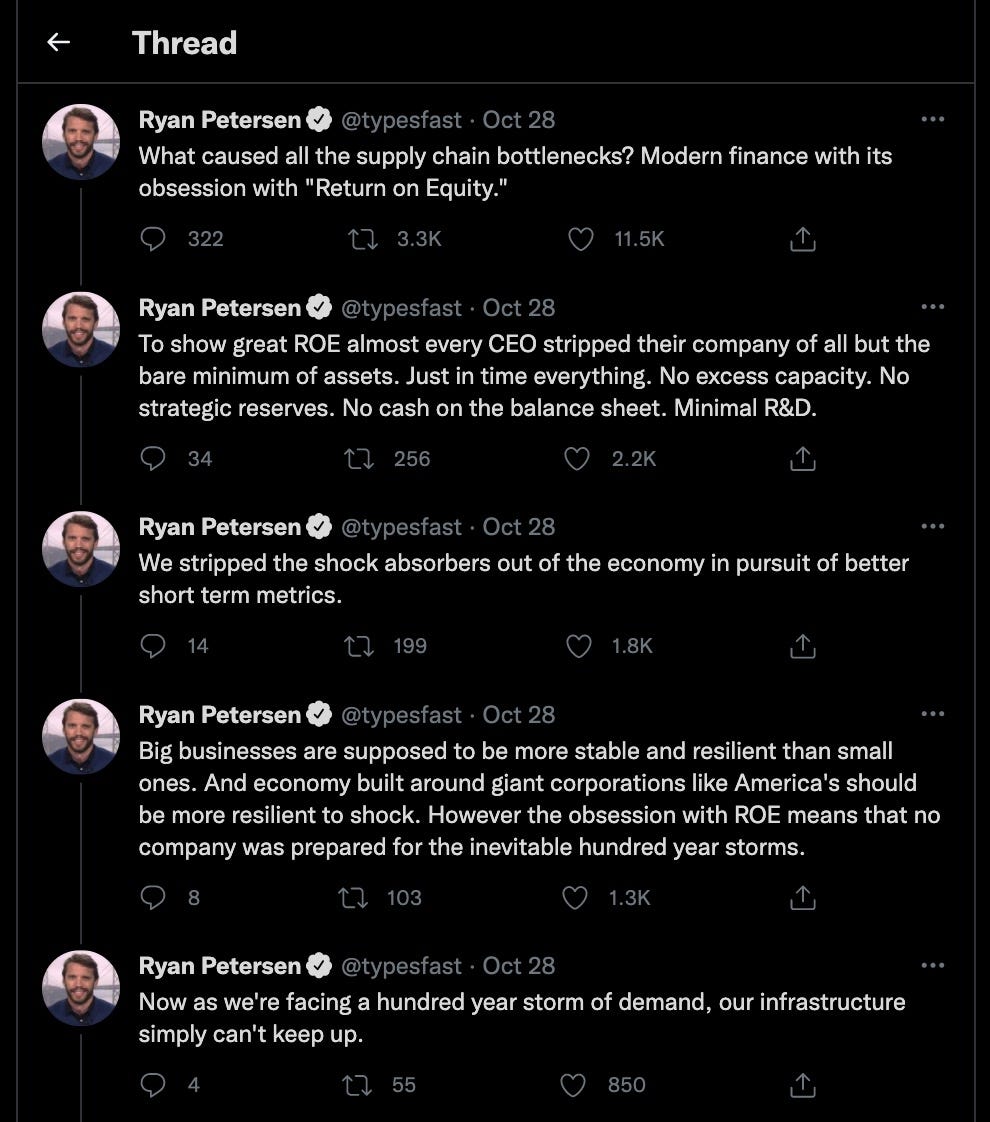

An interesting example of vertical disintegration happened in the US beef business a few years ago as packers spun off their cattle feeding capacity. Why? Because feeding cattle is massively capital intensive and depending on where we are in the cattle cycle, can negatively impact Return on Equity, a key finance metric.

It’s not a direct corollary to meat, but here's an interesting thread on that concept; replace 'supply chain' and 'logistics' with 'meat' and see if some of this doesn't resonate:

Yet over the same time frame that packers divested their cattle feeding businesses, let's call it the last 10 years, retailers have increased their degree of vertical integration in protein with examples like Walmart's milk plants and Costco's chicken plant. Also over the same time frame, packers have moved further downstream into further processing, e.g. case ready plants. Mixed signals, eh?

Cold storage represents another dichotomy in vertical integration.

According to the Global Cold Chain Alliance, cold chain operators see insourcing (customers building their own facilities for cold storage) as a top 3 threat to the business behind driver & workforce shortage and balancing supply & demand. Yet these same third party logistics providers in the cold chain space see that increased customer outsourcing represents a growth opportunity.

Which is it? When is it which?

(Interestingly two other growth drivers for cold chain ahead of customer outsourcing were robotics & automation and growth of ecommerce. 👀)

There are probably a million factors that can impact a management team's decision to increase/decrease vertical integration, things like:

market conditions

company financial health

company ownership structure

company strategy

relative risk level

supplier structure

net cash position

cost of capital

competitive landscape

etc etc etc etc etc…..

My working hypothesis is that ultimately the two driving dimensions for vertical integration are:

1) risk vs control - what is the risk of not having control of this link in the supply chain?

2) reduced cost vs added value - will owning this link in the supply chain reduce cost or increase revenue?

….sometimes those two sets of dimensions are at odds with one another. But here's the thing - that laundry list of factors above? Those are true or false at a given point in time, not in perpetuity. So the structure of the industry should have some ebb and flow over time with regards to the degree of vertical integration. Some hypotheticals:

If land prices fall 50% in the next 5 years, would poultry integrators decide to buy the farm ground to grow corn & soy themselves?

If fed cattle prices increase 60%, would beef packers get back in the cattle feeding game?

What would need to be true to cause pork processors to own their own cold storage instead of leasing capacity as needed?

What would need to be be true to lead pork integrators to divest their growout operations? Sow farms?

Or, is it possible that as packers/integrators increase their core business through consolidation, that it makes more sense to decrease integration? I’ll leave that one to economists and CEO’s.

Back to the original question, how will the current transportation crisis impact the future movement of livestock, meat & milk?

My hypothesis is that we could see a shift back to company owned logistics as a way to control risk, given the massive logistics & labor risk the last 18 months have revealed. At least until autonomous trucking becomes a thing, then we should see more business model innovation unleashed…

…because, keep in mind, this whole discussion about the future of supply chain & logistics is set against a backdrop of not only how rapidly the tech is accelerating but how that technology is enabling new business models, like the one mentioned last week of the WeWork model for freight warehousing. (If you’re not familiar, WeWork is a startup that takes long term leases on commercial office buildings and sells short term leases for customers wanting flex office space. WeWork is also a deliciously disastrous startup trainwreck story for reasons other than their business model.)

Use WeWork or Uber or Airbnb or whatever other consumer business model you want, but the question is, how will those sharing-economy type business models drift into asset heavy, large scale, B2B manufacturing/disassembly businesses? The options used to be either lease or buy the asset, but having more variations in both of those options could change the risk/reward calculus of owning or outsourcing certain parts of the process involved in getting meat, poultry & milk to end customers.

Alternatively, having more predictability could change the calculus. Another example from last week was the idea of freight tech companies that are moving all the pen & paper or Excel based processes to digital, and improving not only visibility of information but of actual cargo in transit. How will those moves towards digitization reduce the risks that integrators perceive, ultimately enabling them to have high confidence in those suppliers to do the activities that need doing but without the integrator having that capability on their own books? Not just in trucking either.

On a final note, consider this perspective from Seizing the Middle: Chess Strategy:

Rockefeller’s strategy was part of a wider transition to a new type of industry, beginning in the 1840s and ending with the crash of the 1920s. Businesses started “seizing the middle” and taking control of the resources they depended on. A single company could take charge of everything from the natural resources required to make a product to the transport systems necessary to deliver it to customers. The implications of this were dramatic.

…the change in business practices allowed managers to start thinking like chess players: a few moves ahead. Being able to anticipate and plan had the undeniably significant effect of allowing companies to invest more in research and development because they could forecast where current trends headed:

“In allocating resources for future production and distribution, the new methods extended the time horizon of the top managers. Entrepreneurs who personally managed large industrials tended, like the owners of smaller, traditional enterprises, to make their plans on the basis of current market and business conditions. . . . The central sales and purchasing offices provided forecasts of future demand and availability of resources.”

To control the game, one tries to control as much of the board as possible. At the outset, using your pieces to seize the middle of the playing field is a great strategy, because it gives you the widest possible vantage point from which to control the movement of the other pieces.

But maybe that word ‘outset’ is the key here. The above description of Standard Oil (and many other businesses across many commodity segments) was reflected in principal in how the meat industry organized itself at the outset….but we aren’t at the outset of the meat business anymore - it’s an old, established business.

So perhaps we are at the outset of a new era. One with new alignments and new business models and new considerations that will inform how ‘vertical integration 2.0’ shapes up across meat, milk & poultry.

What a time to be alive!

More on mental models around bundling & unbundling:

(1) Ben Thompson of Stratechery. Highly recommend, more from a tech perspective but lots of crossover insights.

(2) HBR: How to Succeed in Business by Bundling and Unbundling. This is actually an interview with the tech entrepreneur behind the now infamous quote.

I’m interested in all things technology, innovation, and value creation for every link in the animal protein value chain. I’m currently on the Merck Animal Health Ventures team. Prime Future is where I learn out loud. It represents my personal views only, which are subject to change…’strong convictions, loosely held’.

Thanks for being here,

Janette Barnard

I wonder about the phrase 'capital intensive' ideas. If investors (finance and builders) don't prefer capital intensive business ideas, I mean majority don't want to get into it, (I am reading it a lot and facing in discussions at work... this phrase thrown around everywhere in strategy blogs, sessions) .. ... then who will get into it?

May be we are coming to bundling and unbundling of capital intensive businesses..

A majority of the major poultry packers now contract an immense amount of the portioning, grading, cooking and frying of products. Since the pandemic they are also having to contract the boning process and it is causing a lot of disruption in the cash markets and very costly for the packers.