The overlap between FTX and funny business in cattle feeding

Prime Future 128: the newsletter for innovators in livestock, meat, and dairy

The FTX implosion is a train wreck and I 👏🏽can👏🏽not👏🏽 look away. It's shocking because of the scale of the implosion and the depth of the chaos, and this is just the early hazy days of the aftermath.

But we can learn from anything, right? This one is instructive far beyond the crypto world, all the way into the livestock world.

If you aren't familiar with the FTX story, this and this give a good overview.

"FTX failed after its founder and former CEO, Sam Bankman-Fried, and his lieutenants used customer assets to make bets in Bankman-Fried's trading firm, Alameda Research.

Launched by Bankman-Fried when he was just 28, FTX became one of the largest crypto exchanges in just three years with a valuation of $32 billion. Bankman-Fried used aggressive marketing, including a Super Bowl ad campaign, and the purchase of naming rights to the home of the Miami Heat basketball team.

FTX and FTX.US crashed due to a lack of liquidity and mismanagement of funds, followed by a large volume of withdrawals from rattled investors. The value of FTX’s native token, FTT, plummeted last week, taking other coins down with it including Ethereum and Bitcoin."

What’s the parallel to livestock?

When funny business happens in livestock, it's likely to happen in the cattle feeding business. In the vertically integrated swine & poultry or in dairy where animals do not frequently change hands, there just isn't much room for shysters to maneuver. So cattle feeding seems to attract them all…in the US anyway.

Of course, the funny business is rare; by and large the cattle feeding industry is professionalized and well-managed. Importantly, the bad actors are a thorn in the side of the 99.99% of good actors.

But do a quick scan on the google and you'll find plenty of headlines about, umm, ‘mismanagement’ in cattle feeding from the last few years including some big companies on the receiving end of that bad behavior. (To be fair the Big One was $240M not $32B like FTX so that’s something?)

My hypothesis is that the root causes that allow bad actors in cattle feeding echo the root causes that undid FTX.

This is oversimplifying, but there are (at least) two layers of blame in the FTX story:

An entrepreneur carried away by greed, incompetence, and/or hubris.

Investors allowed an entrepreneur to operate with woefully insufficient governance.

There are a lot of advantages of youth, but it’s hardly surprising that a 30-year-old founder of a company valued at $32 billion maaaaay have been tempted to buy into his own hype.

It's also hardly surprising that a 30-year-old did not have the experience to build a complex financial company with the appropriate guardrails or to know/admit that he needed to hire a management team that could build guardrails into the business, or even to know/admit that he could benefit from a board of directors with the expertise to advise on such matters.

The generous explanation of the situation is youthful hubris and incompetence; the less generous explanation is unbridled greed and negligence. Reality is probably somewhere in the middle, as it usually is.

So, uh yeah, looking out for red flags of those traits in business partners seems like a reasonable rule of thumb.

But nobody looks for shysters to do business with; any sane person runs from the red flags around character.

So the real FTX takeaways are around the governance processes that counterparties put in place with any partnership or investment, whether a cattle-feeding customer, an angel investor in a super-early-stage startup, an established company building a partnership, or a venture fund investing in a growth company.

The practical FTX takeaways are around 3 layers of governance:

(1) Conduct thorough diligence.

I 10/10 recommend the book Bad Blood about Theranos and the company’s journey raising hundreds of billions of dollars to build & scale their technology that could run hundreds of tests from a single drop of blood, only to have the house of cards fall spectacularly. It’s basically a story about inept due diligence.

The author describes how an executive from one of the pharmacy chains that was exploring a partnership with Theranos raised concerns when Theranos management would not allow them to see inside the lab as part of due diligence before signing a major commercial partnership. The exec was saying 'hey this doesn't pass the smell test' but the FOMO train was already running away internally and the exec's concerns were dismissed.

That story speaks to the value of having multiple perspectives evaluate a potential counterparty.

Another diligence lesson from Theranos was that every new investor that came in assumed that the big-name investors that were already invested wouldn’t have invested without having conducted diligence. This happened in funding round after funding round, going back to the original pre-seed investor by a high-ish profile VC whose daughter was childhood best friends with Elizabeth Holmes….

That speaks to the value of doing your own homework, not looking at anyone else’s paper for the answers to the test because even smart people get it wrong or have different objectives than you do.

Theranos, and now FTX, are these gross extremes of why the most basic diligence - just asking the simple questions - shouldn’t be skipped. Even in the frenzy of a bull market, even in the frenzy of venture hype…even in the frenzy to lock in that cattle supply.

(2) Process controls in place.

CME Group CEO Terry Duffy had harsh commentary on the business model of FTX and the lack of risk management and process controls. Duffy pointed out, “you don’t have to accept anything as innovation that puts risk management in the back seat and that’s exactly what was going on.”

First, not everything needs to be innovated on. Sometimes incumbents are just slow to change and sometimes incumbents are the way they are for really really good reason.

Second, at a minimum, good governance includes understanding the internal processes and process controls that a company has in place.

(3) Board oversight that, ya know, actually oversees.

The myth of entrepreneurship is this idea of "not answering to anybody"…that's not a thing. For starters, every business answers to customers. Second, every business with outside investors answers to a board…the well-managed businesses anyway.

Founders can stack the board with their drinking buddies, or they can run the business like a grown-up and assemble a board with people who 1) understand what fiduciary duty means, and 2) actually contribute to the management team running the company. IMO the best founders know how to leverage their board’s expertise for the benefit of the company….they don’t see the board as a negative or even neutral but as a positive, as a resource.

But cattle feeders are not venture-backed startups with boards, especially when they are family-run or independent operations, so maybe that piece of governance doesn’t translate very well for our parallel.

If you read much at all about fraud / funny business in cattle feeding, much of it stems from the fact that by eyeballing a pen of cattle you cannot tell whether those cattle have only your lien on them, or someone else’s also, or who owns them…or the absence/presence of “ghost cattle”.

While technology can solve a big piece of the cattle provenance puzzle, technology alone cannot prevent funny business in cattle feeding or any other type of partnership/investment.

The lack of good governance leaves the door open for bad actors to act badly in any partnership or investment.

I suppose the caveat is that the purpose of verifying robust governance is about reducing the likelihood of funny business even though the Enrons of the world prove the risk may not go to zero. (Btw the WSJ podcast series Bad Bets on how Enron unfolded is 🔥.)

One more thing - I hate these dumpster fires. Easterday, Nikola, Theranos, WeWork, FTX. Sure they make for entertaining podcasts but just like the shysters in the cattle feeding business are bad for the good operators, the knucklehead founders are bad for the good innovators.

But they do serve as cautionary tales.

What are your takeaways from the FTX fiasco?

For those interested in the venture capital side of things, this article is quite relevant:

An exchange? That’s not an unknown business model. Frankfurt exchange has been running for over 4 centuries. We know how this works. We know how brokerage works. When Matt Levine writes about how this is insane, he doesn’t need to, like, study up on esoteric secrets of cryptography. Whether you’re trading baseball cards or stocks or currencies or crypto, a margin loan is a margin loan and a fee is a fee.

What they (investors) should have known however are the basic red flags - does this $25 Billion company, going on a trillion by all accounts, have an actual accountant? Is there an actual management team in place? Do they have, like, a back office? Do they know how many employees they have? Do they engage professional services like lawyers to figure out how to construct the corporate structure maze? Do they routinely lend hundreds of millions of dollars to the CEO?

Sure Temasek didn’t get a Board seat, but did they know there was no Board at all? Or how exactly Alameda and FTX were intertwined, if not all the other 130 entities? It seems sensible to ask these things, even if you’re only risking 0.09% of your capital.

These are hardly deep detailed insane questions you skip in order to close the deal faster.

This isn’t Enron, where you had extremely smart folk hide beautifully constructed fictions in their publicly released financial statements. This is Dumb Enron, where someone “trust me bro”-ed their way to a $32 Billion valuation.

First, focus on the basics: if you're looking at a large financial company where there is no HR team, no accountant and no Board, try not to write multi hundred million dollar cheques. If the founder is regularly taking out absolute mountains of cash from the company to buy properties, donate to charity or blow it on burning a bit of capital for seemingly silly deals, that feels like bad governance.

Second, don’t fall in love more than necessary: Try to internalise the following: “human ability is normally distributed but the outcomes are power law distributed”. What this means is that just because someone builds a company that produces extraordinary outcomes, 10000x the average, doesn’t mean that they were 10000x as capable. Achievements are created from multiplicative outcomes of many different variables. So if you’re investing in a “10x founder” it doesn’t mean that they themselves are 10x the capability of everyone else, but what it means is that their advantage, combined with everyone else’s advantage, can get you to a 10000x outcome.

Which means the adulation we pour on top of some folks creates its own gravitational field, and makes others susceptible to falling in love.

The most difficult task is to not let someone else control your decision making for you, which is what you give up. If your job is to get seduced by the right narrative by the right-seeming person, guess what you’ll get seduced by anyone who can tell a compelling narrative.Do NOT make decisions thinking surely someone else has done their part. As the names get bigger, a new investor thinks “hey, surely Sequoia and Temasek and all these big guys would have done their diligence, this makes me comfortable”, which just isn’t true.

FTX isn't an example of crazy overextension, like WeWork, or outright fraud, like Theranos, but sheer unadulterated incompetence and hubris. The first two are understandable mistakes to overlook because investors are in the risk taking business, and are not detectives. The third is a failure of seeing things right in front of one’s eyes.

FOMO is real and investors are not at all immune, even professional VCs. In many ways, the venture capital model makes complete sense: in order to get outsized returns you take outsized risks which is why investors in venture capital funds (or angel investors in early-stage companies) should recognize that any one investment is likely to go to zero, but the goal is that the portfolio is constructed in a way that any one investment could return the fund.

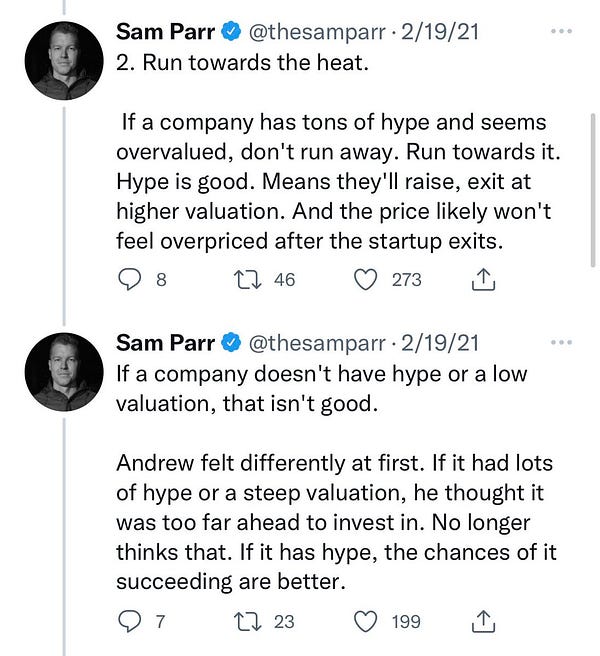

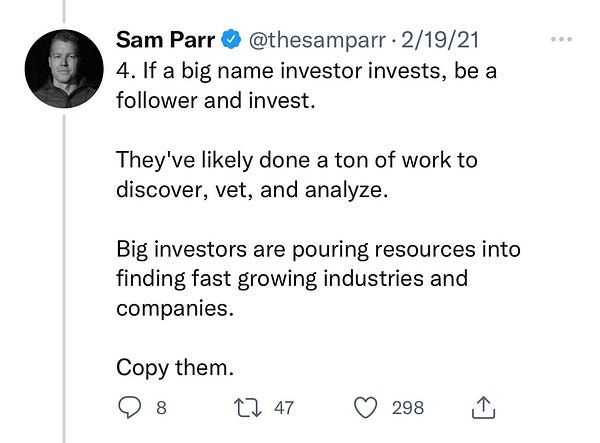

But then I read stuff like this...

...I can only hope a partner at one of the most storied venture funds did not actually say this. Instead of investing out of high conviction in a thesis and betting on companies with the potential to generate real value for all shareholders, the play is to follow the hype and just sell the asset at a higher price to someone else who bought into the hype before the hype dies???

That is hardly inspiring, or even respectable.

But FOMO is also the most likely explanation for all of the money that has simultaneously flocked to alternative meat startups or indoor ag startups or pick your other flavor-of-the-year venture-backed categories.

There has to be a better way to fund the future. What is it?